Navigating Dental Insurance Plans in 2025: What You Need to Know

Meta Description: Learn how to choose the best dental insurance plan in 2025. Compare coverage tiers, premiums, network restrictions, and preventive benefits to protect your smile and your wallet.

Introduction

Finding the right dental insurance plan can feel overwhelming. With new providers, changing networks, and evolving benefits, it’s hard to know where to start.

In this guide, English-speaking readers in the US, Canada, and the UK will learn five key factors to consider when evaluating dental plans—so you can maintain your oral health without breaking the bank.

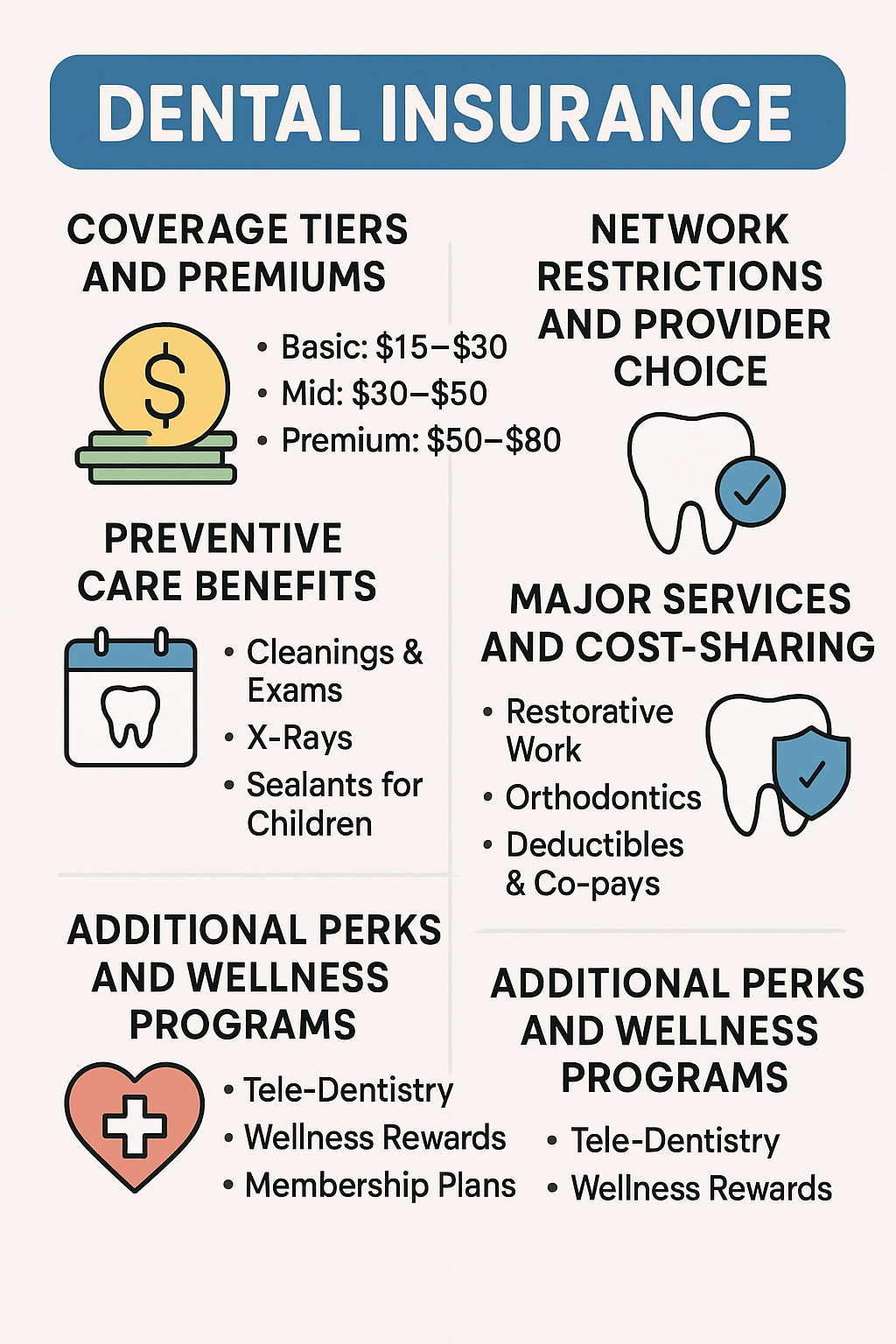

1. Coverage Tiers and Premiums

-

Plan Levels: Most insurers offer Basic (preventive), Mid (basic + major services), and Premium (all services).

-

Monthly Premiums:

-

Basic: $15–$30

-

Mid: $30–$50

-

Premium: $50–$80

-

-

Annual Maximums: Check yearly caps—common limits range from $1,000 to $2,500.

-

Waiting Periods: Some plans require 3–12 months before major procedures are covered.

2. Network Restrictions and Provider Choice

-

In-Network vs. Out-of-Network:

-

In-network dentists agree to discounted rates.

-

Out-of-network care costs more but offers greater provider freedom.

-

-

Directory Search: Use online tools to see which local dentists participate.

-

Referrals & Specialist Access: Confirm if orthodontists or periodontists require referrals and whether specialist visits are covered.

3. Preventive Care Benefits

-

Routine Cleanings & Exams: Most plans cover two cleanings per year at 100%.

-

X-Rays & Fluoride Treatments: Often included under preventive care.

-

Sealants for Children: Check if sealants on molars are fully covered up to age 16.

-

Oral Cancer Screenings: Increasingly offered as part of comprehensive check-ups.

4. Major Services and Cost-Sharing

-

Restorative Work: Fillings, crowns, and bridges typically covered at 50–80%.

-

Orthodontics:

-

Coverage varies widely; lifetime maximums often apply.

-

Adult braces may only be partially covered (50%).

-

-

Implants & Periodontal Treatments: May require a premium plan or separate rider.

-

Deductibles & Co-pays: Look for low deductibles ($50–$150) and reasonable co-pays per service.

5. Additional Perks and Wellness Programs

-

Tele-Dentistry Consults: Virtual screenings for minor concerns and follow-ups.

-

Wellness Rewards: Some plans offer gift cards or premium discounts for completing care milestones.

-

Membership Plans: Direct-to-consumer monthly subscriptions that bundle cleanings, X-rays, and discounts on other services.

-

Global Coverage: For frequent travelers, verify emergency dental benefits abroad.

How to Compare and Enroll

-

List Your Needs: Note any upcoming procedures and routine care requirements.

-

Gather Quotes: Use comparison sites to request at least three quotes across coverage tiers.

-

Read the Fine Print: Pay attention to annual maximums, waiting periods, and exclusions.

-

Consult Your Dentist: Ask if they recommend any particular carriers based on their experience with claims.

-

Enroll During Open Enrollment:

-

US: Usually November–December

-

Canada & UK: Enrollment periods vary by province and insurer

-

Conclusion

Selecting the best dental insurance plan in 2025 comes down to balancing cost, coverage, and convenience. Prioritize a plan that offers strong preventive benefits, reasonable cost-sharing for major work, and access to your preferred dentists.

With the right policy, you’ll enjoy a healthier smile and greater peace of mind—today and for years to come.